Unsecured loans generally element greater interest rates, decreased borrowing boundaries, and shorter repayment terms than secured loans. Lenders might from time to time require a co-signer (a one who agrees to pay for a borrower's debt should they default) for unsecured loans In case the lender deems the borrower as dangerous.

Credit rating wanted for a personal loan calculator: See what personal loan options may be accessible to you, determined by your credit rating.

LendingClub is a strong lender forever credit borrowers and some honest credit borrowers that use directly on its website. It is simple to prequalify with LendingClub, particularly when you might be awkward delivering your Social Stability quantity, as the corporation isn't going to have to have it on the prequalification phase. (You must supply it if you move ahead which has a entire software.)

We manage a firewall concerning our advertisers and our editorial group. Our editorial team does not receive immediate compensation from our advertisers. Editorial Independence

Health-related loans: For those who’re within a money bind as a result of large health-related costs, a private loan might be a great way to pay health-related costs off and distribute the payments out more than several yrs.

Just about every lender has its personal methods of assessing borrowers and determining rates, so it’s a smart idea to Assess prequalified rates from multiple lender. Generally, the shorter the loan term, the reduced the interest rate supplied by most lenders; and the greater your credit rating and credit report, the better the interest rate it is possible to qualify for.

Launched in 2000, Certain Rate specializes in offering a digital mortgage practical experience for The original source borrowers. Consumers can peruse online sources and specifics of mortgage refinancing to assist decide which selection matches their economical goals.

Character—may well include credit background and reviews to showcase the background of a borrower's ability to satisfy debt obligations up to now, their function working experience and revenue stage, and any remarkable authorized criteria

Watch our house shopping for hubGet pre-accepted for just a mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs acquire calculatorHow much can I borrow mortgage calculatorInspections and appraisalsMortgage lender critiques

Suggestion: You might get the money as early as one particular to two business days immediately after acquiring authorised and accepting the loan terms.

These disclosures will element each time a challenging pull may perhaps arise, in addition to other terms and disorders of one's preferred Provider's and/or final lender's services.

VA loans don’t have to have mortgage insurance and loan restrictions don’t utilize. Nevertheless, a VA funding cost may be required based on the down payment and whether the veteran has used their VA gain follow this link in advance of.

The rate commonly released by financial institutions for conserving accounts, income market place accounts, and CDs could be the yearly proportion produce, or APY. It's important to grasp the distinction between APR and APY. Borrowers seeking loans can determine the actual interest compensated to lenders primarily based on their Website link advertised rates by using the Interest Calculator. For more info about or to accomplish calculations involving APR, be sure to take a look at the APR Calculator.

Test your credit rating Before you begin crunching any numbers. Individual loan yearly proportion rates (APRs) can vary from just under 8 % every one of the way as many as 35.

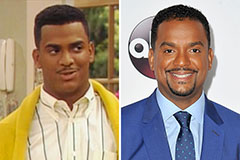

Alfonso Ribeiro Then & Now!

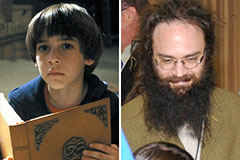

Alfonso Ribeiro Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now!